Terrydale Capital is a leading-edge commercial financing firm focused on bringing our clients the most accurate, up-to-date capital market knowledge, through our deep Lender and Broker relationships, innovative technology, and industry experience.

We provide the highest level of customer service by delivering constant communication, creative solutions, and concise guidance throughout the process.

Our Services

Our extensive experience in Commercial Real Estate has allowed us to finance a diverse range of property types, including multifamily, retail, industrial, self-storage, and more. Our team has a deep understanding of the unique challenges and opportunities in each market, and we work with our clients to develop customized financing solutions that fit their specific needs.

Our Advisory & Consultation services provide a specialized approach to complex financing scenarios. Our team offers tailored solutions and strategic guidance to help clients make informed decisions and achieve their financial goals. Whether it's navigating challenging lending requirements, restructuring existing debt, or planning for future growth, we have the expertise and resources to provide comprehensive support every step of the way.

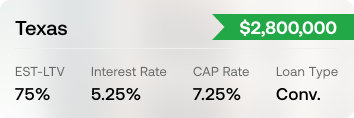

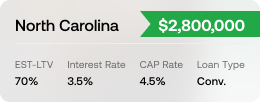

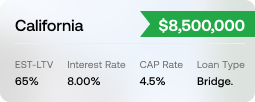

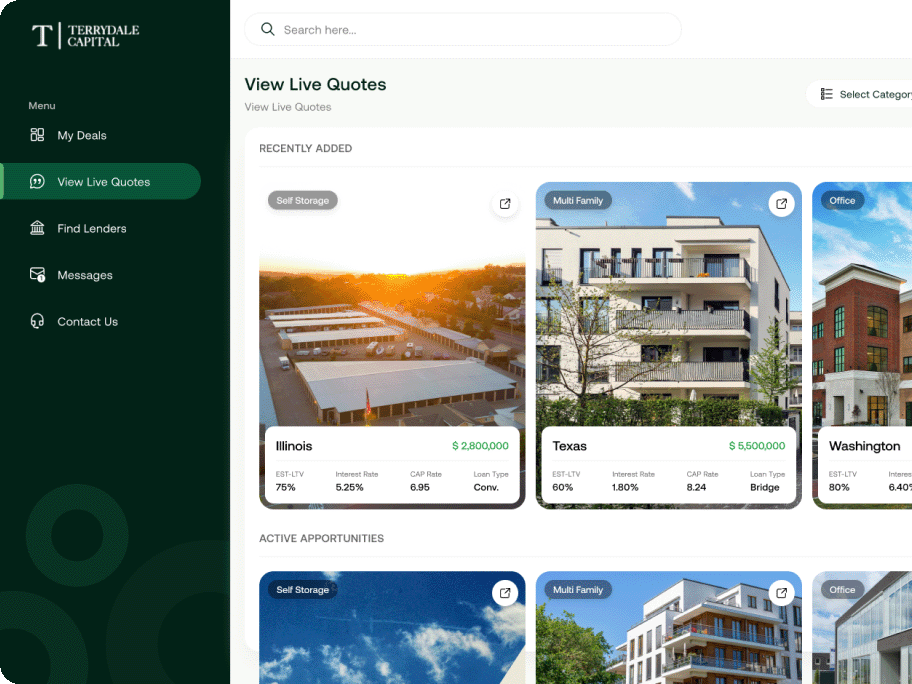

Experience the full range of services and opportunities offered by Terrydale Capital. By partnering with us, you gain access to a comprehensive suite of services including commercial financing, deal prospecting, investor resources, networking, live quotes, and instant loan requests. Leverage our expertise and extensive network to unlock unlimited possibilities in the commercial real estate industry.

Recently Closed Deals

Your Success Is Our Top Priority

Cody Baker and the entire team at Terrydale Capital are spectacular. They recently helped us with a cash out refi which moved quickly and smoothly, with great terms. This is the third time they have helped us, and Cody’s great work ethic, communication, and willingness to advocate on our behalf has his team as our go-to broker! Thanks!

Max Laitner and the rest of the team at Terrydale did an amazing job getting us set up with a cash-out refi on a multifamily property. The process was easy and terms were great even after some delays on our end. Any time we had questions or concerns Max was on the phone with us in an instant. Max and Terrydale are our go-to commercial mortgage brokers and I highly recommend them!

Cody Baker at Terrydale Capital placed a great loan for us on a Boat & RV Storage property. He was instrumental in helping us negotiate some creative terms with our lender and ultimately closed a deal with which we are very pleased. We will definitely do more CRE loan business with Terrydale in the future.

I'm the Director of Loan originations at a commercial lender. I've worked with "Team Terrydale" for almost two years. Of the 1000's of brokers I work with, they are at the top. Everyone is incredibly professional, prepared, and a pleasure to work with. They close more loans than just about any brokerage their size. I can't recommend them enough.

After working with another broker for almost eight months with no success, we met Culby and Amy at Terrydale. This company came around and quickly helped us close a 72-unit apartment complex in Waco, TX. Culby was very honest and transparent through the entire process. We we able to close in about a month with no issues. Great company and a great group of hard working people. We will continue to work with them to purchase more apartments!

My partners and I needed a very unique loan on a piece of land that had a short fuse on closing. The property was also a high velocity transaction that would not work for traditionally lenders. Cody and the Terrydale team located a lender for me that moved fast and had an extremely professional team to work with. Thank you so much for you help closing this deal

First time commercial property buying is a harrowing experience. We had to learn a new "investment" language. Cody Baker and the crew at Terrydale Capital made the experience exponentially easier. The wealth of information shared with us was invaluable. Communication was excellent as Cody helped guide and maneuver through the multiple emails as well as entities required for the closing process. Would highly recommend TDC for your next investment endeavor.

Recently worked with Cody and Brian on a storage facility investment. Due to the nature of the accounting done by the prior owner no banks would entertain the investment because it didn't look good on paper. The guys at Terrydale took the time to underwrite the deal and present it to several banks all of which approved the deal. Cody worked very hard in helping us every step of the way from underwriting all the way through the end. Brian was also there whenever we needed another angle.

Terrydale was excellent every step of the way. As a first time buyer of commercial property it was great to know that I had financing taken care of. Their team also made the closing much easier as we had issues with our title company, but Terrydale's team got us great terms with our lender, streamlined the closing process, and made it all very easy. Thanks again!

Terrydale Blog