Our Structured Loan Products Are

Based On Six Programs

Permanent Loans

TDC offers permanent financing solutions that can either be your first step or the evolution to a bridge loan offering. Our relationships with and access to all the major permanent lenders in the country allow us to shop your ideal terms.

Bridge/ Mini Perm Loan

Need short-term financing to take advantage of an investment opportunity? TDC’s bridge loan options let you quickly meet your current obligations until you get the chance to sit down and work out a permanent solution.

Hard Money

While hard money loans require property as collateral and should only be used as a fallback, Terrydale Capital ensures you can secure these higher-cost, lower-LTV ratio deals from reputable individuals and companies on the best possible terms.

Construction Loans

>Want to build your own property from the ground up? Need the capital to do it? Our relationship with construction lenders nationwide gives you a competitive advantage when you’re ready to break ground

Business Funding

From startup and expansion to disaster recovery, our loan programs are available to help your business keep its doors open. To learn more about our business funding programs.

Agency Lending

Agency lending connects borrowers with government-sponsored entities and agencies, such as Fannie Mae and Freddie Mac, providing a reliable resource for accessing flexible financing options in the commercial real estate market.

Bridge/ Mini Perm Loan

Need short-term financing to take advantage of an investment opportunity? TDC’s bridge loan options let you quickly meet your current obligations until you get the chance to sit down and work out a permanent solution.

Construction Loans

Want to build your own property from the ground up? Need the capital to do it? Our relationship with construction lenders nationwide gives you a competitive advantage when you’re ready to break ground

Agency Lending

Agency lending connects borrowers with government-sponsored entities and agencies, such as Fannie Mae and Freddie Mac, providing a reliable resource for accessing flexible financing options in the commercial real estate market.

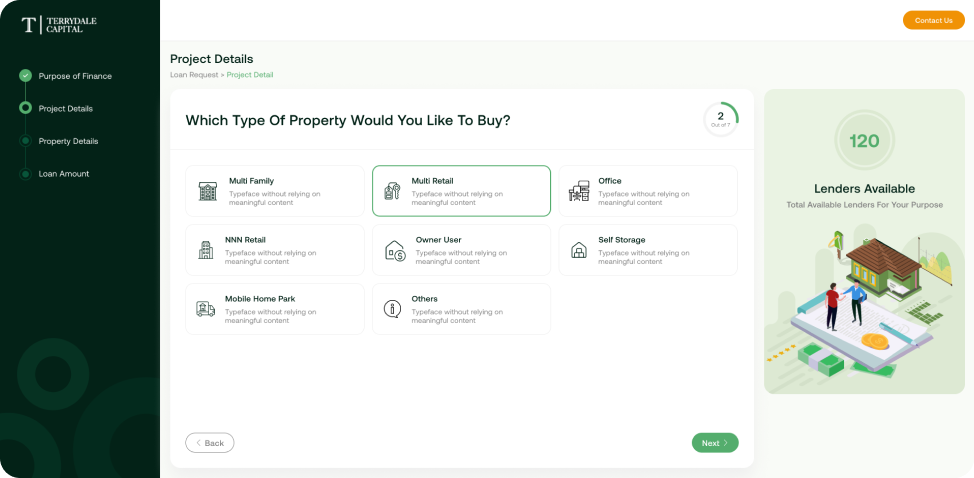

Property Types

Our Debt Resources

Our focus on timely and professional responses to your financing needs and our strong relationships with credible and experienced lenders nationwide provides confidence and value in your commercial real estate loan experience.

Bank

Terrydale Capital has built strong relationships with the nation’s top banks, and can quickly compare typical offers from traditional lenders.

HUD / FHA

We stay up to date on loan options for clients with lower credit scores and limited cash flow who may be eligible for a guaranteed mortgage on a property.

FNMA / FREDDIE MAC

Preferred by lenders, Fannie and Freddie loans are another alternative for clients with low to mid income or a lower credit score to secure a loan.

DEBT FUNDS

Are you a developer or experienced investor in need of short-term capital for one of your projects commercial real estate projects? It has access to debt fund solutions.

FAMILY OFFICE

Unlock the potential of family offices as a debt resource to fuel your investment with flexible financing options.

CREDIT UNION

With their member focus, greater flexibility, and lower rates, TDC is proud to maintain long relationships with many of the nation’s trusted credit unions.

CMBS

Whatever the size of your investment, CMBS offers a path to non-recourse financing on commercial properties of almost any size.

LIFE CO

An often overlooked source of financing, life insurance companies have served a significant number of our commercial real estate clients.