2025 Bridge Loan Rates: Why Texas and Kansas City Outperform Coastal Markets

Terrydale Capital

Nov 3, 2025 2 Min read

Market Updates

Market Updates

Bridge Loan Briefing: Understanding the Terrain in 2025

Bridge loans are short-term financing tools designed to “bridge” gaps—often used for acquisitions, renovations, or transitional properties that don’t yet qualify for permanent financing. They’re typically interest-only, faster to close, and carry higher rates than long-term debt due to their risk profile and flexibility.

In 2025, rates have remained elevated, but not uniformly.

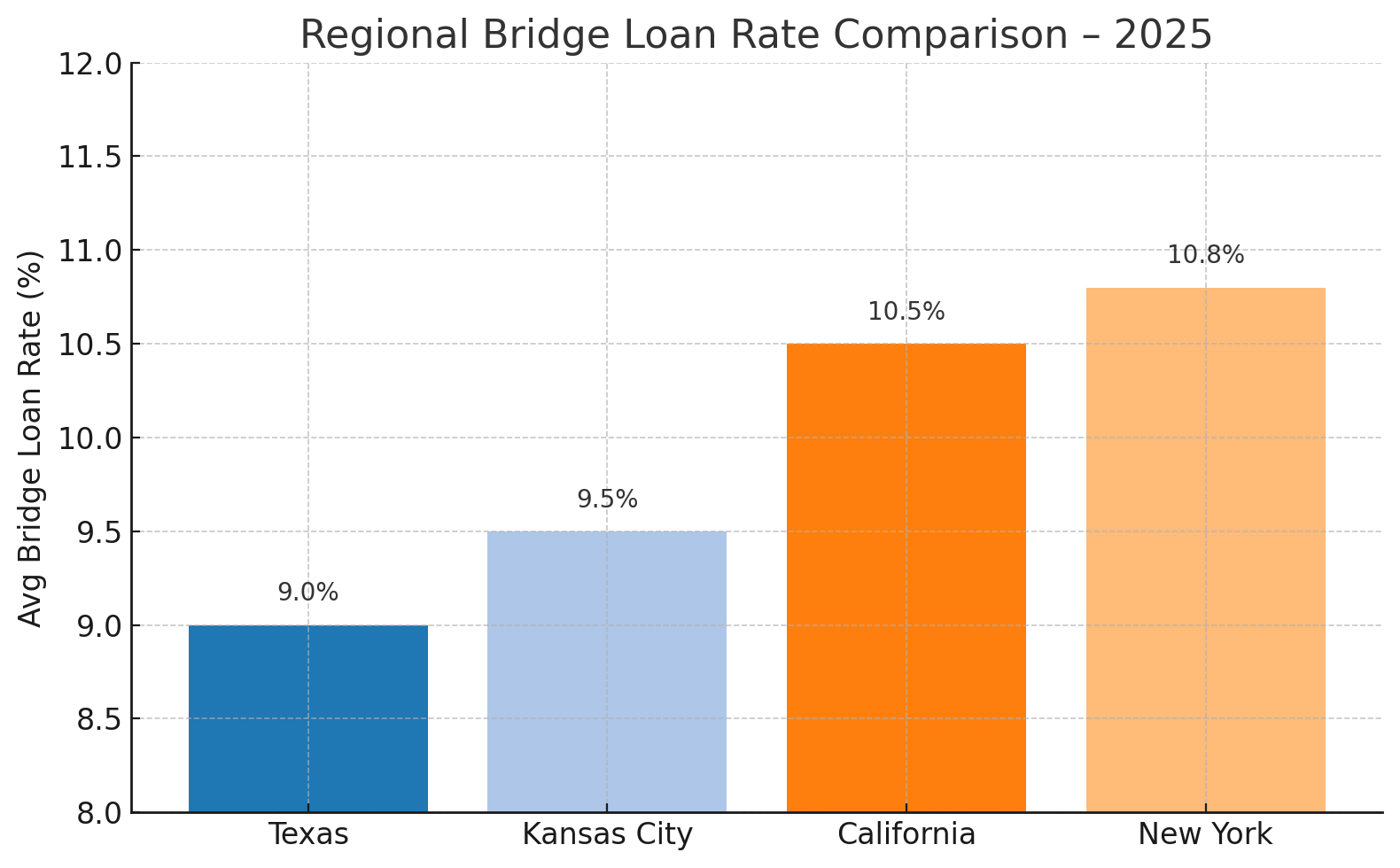

Regional Rate Snapshot:

This chart highlights how bridge loan pricing varies significantly by market. Texas and Kansas City lead with more competitive rates—often 100 basis points lower—thanks to strong lender competition and local economic fundamentals. In contrast, markets like California and New York continue to demand a premium due to higher perceived risk and tighter lending conditions.

For investors seeking value-add or transitional opportunities, this regional rate spread presents a strategic advantage in middle-market metros. Knowing where capital is cheaper isn’t just trivia—it’s leverage.

The Takeaway

If you’re pursuing a value-add or lease-up deal, regional lending dynamics matter. Cheaper capital in Texas or Kansas City could mean better IRR and more flexible terms. Understanding these differences isn’t just helpful—it’s strategic.

Looking for insights tailored to your next bridge loan?

Visit Terrydale Capital or explore live market data via Terrydale Live.

Partner With Terrydale Capital for Your Debt Financing Needs

When it comes to debt financing, understanding the right timing, process, and options is crucial. At Terrydale Capital, we provide a comprehensive range of commercial loan solutions tailored to meet your business's unique needs.