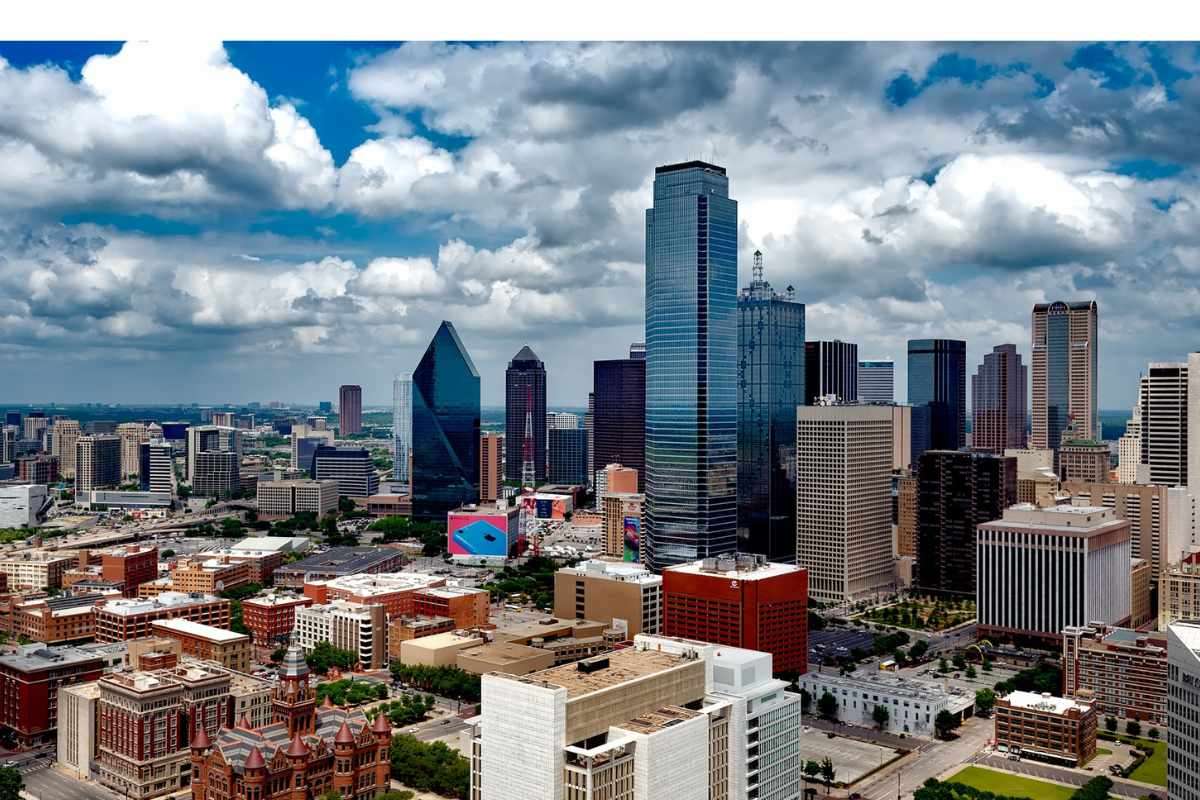

Apartment Building Loan Solutions in Dallas & DFW

Terrydale Capital

Aug 12, 2025 6 Min read

Market Updates

Market Updates

Investing in an apartment building can be a lucrative opportunity in high-growth areas like Dallas, McKinney, Prosper, and across the DFW metroplex. Whether you’re a first-time investor or a seasoned developer, finding the right financing is essential to maximizing returns and minimizing risk. From apartment building loans to bridge loans and construction loans for multifamily projects, understanding your options is the first step toward success.

Understanding Apartment Building Loans

Apartment building loans—also known as apt loans—are financing options specifically designed for purchasing, refinancing, or improving multi-unit properties. These loans can vary widely depending on your project’s scope, your creditworthiness, and the type of property.

For example, if you’re wondering how to get a loan for an apartment, the process often involves:

- Determining your budget and property type

- Gather your financial documents and business plan

- Selecting the right lenders

- Applying for pre-approval to understand your borrowing power

By working with lenders experienced in the multifamily sector, you can access better terms and faster approvals.

Bridge Loans for Fast Transactions

In competitive markets like Dallas and DFW, bridge loans are a powerful tool for investors who need quick funding. If you’re asking who offers bridge loans, these are typically provided by private lenders or specialized commercial financing companies.

Bridge loans work well when:

- You need to secure a property before long-term financing is available.

- You’re renovating a building to increase its value before refinancing.

- You’re in between selling one property and buying another.

This short-term financing solution can be the bridge (pun intended) between opportunity and profitability.

Construction Loans for Multifamily Developments

If you’re planning to build from the ground up in McKinney or Prosper, a construction loan for multifamily projects is likely your best option. These loans provide funding throughout the building process, usually disbursed in stages as construction milestones are met.

The advantages include:

- Access to funds as your project progresses.

- The ability to roll construction financing into a permanent mortgage.

- Flexible terms tailored to development timelines.

A commercial loan for multi-family properties can also be used for large-scale renovations or property expansions.

Working With Apartment Building Lenders

Choosing the right apartment building lenders is critical. You’ll want a partner who understands local market trends in Dallas, McKinney, Prosper, and the broader DFW area. Lenders specializing in multifamily properties can guide you toward loan programs that align with your goals, whether that’s quick closing, favorable interest rates, or high leverage options.

Local Market Considerations in DFW

The DFW area continues to be one of the fastest-growing metro regions in the country, with strong demand for rental housing. This means more opportunities for investors, but also more competition. The right financing strategy can help you secure prime properties before they’re gone.

Local lending institutions and national lenders with regional expertise can help you navigate zoning laws, market conditions, and investment opportunities unique to North Texas.

Find the Right Loan Program

If you’re ready to explore your financing options for apartment building, bridge, or construction loans for multifamily properties, working with a specialized commercial loan advisor is key.

You can learn more about tailored financing solutions by visiting Terrydale Capital’s Loan Programs. Their expertise in commercial loans for multi-family investments makes them a valuable resource for investors across Dallas, McKinney, Prosper, and the entire DFW region.

Partner With Terrydale Capital for Your Debt Financing Needs

When it comes to debt financing, understanding the right timing, process, and options is crucial. At Terrydale Capital, we provide a comprehensive range of commercial loan solutions tailored to meet your business's unique needs.